HTH Worldwide TravelGap Single Trip Travel Medical Plan...

Planning to travel abroad can be an exciting time and at the same time be filled with risks. The world is definitely filled with challenges and rewards but when you travel outside your home country you need to make sure you have the tools and resources to help guide you to and pay for medical expense that can arise during your travels. Depending on which state you reside in you are more than likely eligible for one of the premier travel medical plans available today from HTH Worldwide.

Planning to travel abroad can be an exciting time and at the same time be filled with risks. The world is definitely filled with challenges and rewards but when you travel outside your home country you need to make sure you have the tools and resources to help guide you to and pay for medical expense that can arise during your travels. Depending on which state you reside in you are more than likely eligible for one of the premier travel medical plans available today from HTH Worldwide.

Get The Brand

HTH Worldwide is the proud owner of two distinctive branded travel medical products available today to all U.S. legal residents. The TravelGap Single Trip product from HTH Worldwide and the NEW GeoBlue Voyager Choice plan from GeoBlue a Blue Cross Blue Shield brand.

Two Plans Offered - SingleTrip Preferred & Single Trip Economy

Single Trip Preferred Plan Highlights

- Choice of varying medical limits and deductibles

- For trips up to 6 months for ages 84 or younger

- Covers per-existing conditions for medical services and medical evacuation

- Benefit Maximum Choices of $50,000, $100,000, $500,000, $1,000,000

- Emergency Medical Evacuation up to $500,000 per insured

- Deductible options of $0, $100, $250, $500

- Inpatient and Outpatient covered at 100%

- Does Not requires a primary health plan**

Single Trip Economy Plan Highlights:

- Choice of varying medical limits and deductibles

- For trips up to 6 months for ages 84 or younger

- Covers per-existing conditions for medical services and medical evacuation

- Benefit Maximum Choices of $50,000, $100,000, $500,000, $1,000,000

- Emergency Medical Evacuation up to $500,000 per insured

- Deductible options of $0, $100, $250, $500

- Inpatient and Outpatient covered at 100%

- Requires a primary health plan**

- For those with no Primary Insurance select the TravelGap EconomyPlan Option

HTH TravelGap Not Available in all States

If you live in any of the following states you must enroll through the HTH Worldwide Branded product TravelGap. TravelGap is essentially the same product as the Voyager Single-Trip plan. TravelGap is a Single Trip short term travel medical plan that offers the same benefits of the GeoBlue Voyager plan but in certain states the Voyager plan is not available so we use the TravelGap product. The states that TravelGap is available in are as follows:

- Alaska

- Colorado

- Connecticut

- Maine

- Maryland

- Minnesota

- Montana

- Nevada

- New Hampshire

- Texas

- Utah

- Vermont

- Washington

- Get A Quote Now

ALL OTHER STATES SCROLL DOWN TO THE GEOBLUE VOYAGER PLAN

TravelGap Multi-Trip Plans

TravelGap Multi-Trip Plans

There are many people who frequently travel outside the borders of the United States to visit family, friend or to just get away. If you are a frequent International traveler the Multi-Trip plan may be the right plan for you. TravelGap Multi-Trip from HTH Worldwide (Owner of the GeoBlue Brand) provides the frequent traveler with international health insurance for multiple trips throughout the year. It also includes a complete package of services to help you identify, access and pay for quality healthcare anywhere in the world.

There are many people who frequently travel outside the borders of the United States to visit family, friend or to just get away. If you are a frequent International traveler the Multi-Trip plan may be the right plan for you. TravelGap Multi-Trip from HTH Worldwide (Owner of the GeoBlue Brand) provides the frequent traveler with international health insurance for multiple trips throughout the year. It also includes a complete package of services to help you identify, access and pay for quality healthcare anywhere in the world.

TravelGap Multi-Trip fills health and safety gaps Internationally:

- Insurance - Even if you are already enrolled in a health plan, your coverage is limited when you travel abroad. In fact, your plan may not pay to have you safely evacuated if you are critically ill.

- Information - Where do you turn to learn which hospitals and physicians meet your standards? Keep up with breaking news about health and safety threats? Translate key medical terms and brand-name drugs?

- Access to quality care - How do you find a western trained, English speaking doctor with the appropriate skills? How do you arrange a convenient appointment?

Each TravelGap Multi-Trip policy includes 24/7 access to HTH Worldwide's customer service team and global health and safety tools. Two level of Medical Benefits to choose from, SILVER and GOLD plan options.

Emergency Medical Evacuation

World travelers need to properly protect themselves against financial exposure due to catastrophic medical events. If comprehensive travel medical benefits and assistance services are not secured before you travel, you could find yourself exposed to huge losses - both physical and financial. Though illness can strike at any time, when severe incidents occur overseas, lack of proper coverage can leave you the traveler with steep medical bills for less than sufficient care.

World travelers need to properly protect themselves against financial exposure due to catastrophic medical events. If comprehensive travel medical benefits and assistance services are not secured before you travel, you could find yourself exposed to huge losses - both physical and financial. Though illness can strike at any time, when severe incidents occur overseas, lack of proper coverage can leave you the traveler with steep medical bills for less than sufficient care.

As a global traveler you need to be prepared for the possibility that you could find yourself in a location where the Medical Care is poor or inaccessible. In the event you find yourself in a situation where you need to be evacuated to an area where you can receive the appropriate level of care then you need to make sure your International coverage includes a comprehensive Emergency Medical Evacuation benefit. Medical evacuations are not a simple procedures and they can be extremely complicated and expensive. This must be available to you 24/7 no matter where in the world your travels take you. In addition you need a partner who is capable of organizing and caring out the evacuation no matter where you find yourself.

Considerations for any medical evacuation are:

- Evaluating the appropriateness of local health care providers

- Identifying the closest facility where a high level of care is available

- Determining the risk vs rewards of moving the patient

- Choosing the best method of transport (ie: ambulance, helicopter, fixed wing air ambulance)

- Securing the cooperation of the local treating physician, including a determination that the patient is stable enough to move

- Enlisting the most appropriate team to handle the transport (ie: doctor, nurses, therapist)

- Arranging for speedy and appropriate intake at the receiving facility

- Having someone on your side helping guide you through the whole process - that is GeoBlue...

Make sure when you travel, you travel with a full service, travel health plan that provides a higher level of protection and peace of mind than standard evacuation memberships offer. If you are not sure about your current plan or one you are considering make sure you get a copy of your certificate of coverage and read it. Make sure you have a complete picture of what you are buying. Then cover yourself with the Power of Blue. GeoBlue offers this type of comprehensive coverage and it is built into their Voyager Choice and Voyager Essential Travel Medical plans.

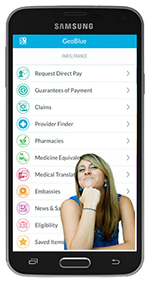

Global On Your Mobile

Like GeoBlue, HTH Worldwide provides access to amazing tools and level of care via a Smart Phone application which you download to your phone prior to departure. The HTH mobile app called mPassport provides access to the best local doctors, hospitals and resources anywhere in the world. HTH's mMobile App helps you make the most of your travels by providing you with the tools to manage existing and unanticipated health conditions in faraway places where finding a doctor and explaining your symptoms should not be left to chance. mPassport brings you specific information and expert assistance to prepare and protect you no matter your destination.

Like GeoBlue, HTH Worldwide provides access to amazing tools and level of care via a Smart Phone application which you download to your phone prior to departure. The HTH mobile app called mPassport provides access to the best local doctors, hospitals and resources anywhere in the world. HTH's mMobile App helps you make the most of your travels by providing you with the tools to manage existing and unanticipated health conditions in faraway places where finding a doctor and explaining your symptoms should not be left to chance. mPassport brings you specific information and expert assistance to prepare and protect you no matter your destination.

Features of mMobile

- Search Providers for medical, dental, or mental health care. Mapping via GPS technology

- Request an appointment with a trusted HTH Worldwide or GeoBlue Provider

- Arrange Direct Pay

- Access Guarantees of Payment

- File a Claim via your phone

- Find a medication

- Translate Medicare terms and phrase.

- Display an ID Card on a smart phone and send copy directly to provider

- mMobile travels with your 24/7

GeoBlue Voyager Choice Single Trip Plans...

GeoBlue Voyager is a short term, Single Trip travel health insurance plan that includes services to help you identify, access and pay for quality healthcare. If you do not live in one o the states listed above then you are eligible for the Voyage Choice from GeoBlue. GeoBlue Voyager fills health and safety gaps internationally:

GeoBlue Voyager is a short term, Single Trip travel health insurance plan that includes services to help you identify, access and pay for quality healthcare. If you do not live in one o the states listed above then you are eligible for the Voyage Choice from GeoBlue. GeoBlue Voyager fills health and safety gaps internationally:

Insurance - Even if you are already enrolled in a health plan, your coverage is limited when you travel abroad. In fact, your plan may not pay to have you safely evacuated if you are critically ill.

Information - Where do you turn to learn which hospital and physicians meet your standards? Keep up with breaking news about health and safety threats? Translate key medical terms and brand-name drugs?

Access to Quality Care - How do you find a western-trained, English-speaking doctor with the appropriate skills? How do you arrange a convenient appointment? Each GeoBlue Voyager policy includes broad , deep and reliable Global Health and Safety Services easily accessed through the web or their toll-free customer service center.

Two Plans Offered - Voyager Essential & Voyager Choice

Voyager Essential Plan Highlights

- Choice of varying medical limits and deductibles

- For trips up to 6 months for ages 84 or younger

- Covers per-existing conditions for medical services and medical evacuation

- Benefit Maximum Choices of $50,000, $100,000, $500,000, $1,000,000

- Emergency Medical Evacuation up to $500,000 per insured

- Deductible options of $0, $100, $250, $500

- Inpatient and Outpatient covered at 100%

- Does Not requires a primary health plan**

Voyager Choice Plan Highlights:

- Choice of varying medical limits and deductibles

- For trips up to 6 months for ages 84 or younger

- Covers per-existing conditions for medical services and medical evacuation

- Benefit Maximum Choices of $50,000, $100,000, $500,000, $1,000,000

- Emergency Medical Evacuation up to $500,000 per insured

- Deductible options of $0, $100, $250, $500

- Inpatient and Outpatient covered at 100%

- Requires a primary health plan**

- For those with no Primary Insurance select the Voyager Essential Plan Option

**Primary Plan is a Group Health Benefit Plan, an individual health benefit plan or a governmental health plan designed to be the first payer of claims (such as Medicare) for an Insured Person prior to the responsibility of this Plan. Such plans must be coverage limits in excess of $50,000 per incident or per year to be considered a Primary Plan.

Voyager For U.S. Students and Faculty

Voyager For U.S. Students and Faculty

If you are an out-bound student or faculty member and your stay abroad will be less than 6 months than the GeoBlue Voyager Choice and Essential plans may be your best option. Like the Voyage plan above - if you have an existing domestic health insurance plan than the Voyager Choice will cover pre-existing conditions for medical services and medical evacuation. If you don't have an existing domestic heath plan than don't worry you simply enroll in the Essential plan. Should you decide to extend your stay overseas longer than 6 months you have two options. First you can renew your Voyager Plan for a new 6 month period or you can apply for an Expat plan that will cover you indefinitely. The choice is yours.

If you are an out-bound student or faculty member and your stay abroad will be less than 6 months than the GeoBlue Voyager Choice and Essential plans may be your best option. Like the Voyage plan above - if you have an existing domestic health insurance plan than the Voyager Choice will cover pre-existing conditions for medical services and medical evacuation. If you don't have an existing domestic heath plan than don't worry you simply enroll in the Essential plan. Should you decide to extend your stay overseas longer than 6 months you have two options. First you can renew your Voyager Plan for a new 6 month period or you can apply for an Expat plan that will cover you indefinitely. The choice is yours.

Need coverage for more than 6 months as a student or faculty member? GeoBlue offers their Navigator Series which will provide cover from as few as three months up to as long as you renew the plan.

CLICK HERE FOR MORE INFORMATION

Save 10% When you apply as a group with GeoBlue

When you travel as a group for trips of less than 180 days and if you have at least five people in your group then you may qualify for the GeoBlue Voyager Choice Group plan. With five or more people in your party you can save an additional 10% on your travel medical insurance premiums. It is easy to get a quote for your group.

Eligibility Requirements

- Home Country is the U.S. and;

- You must be under age 85 and;

- Enrolled in a Primary Plan** and ;

- For Children under age 6, must be enrolled with a parent and;

- Initial purchase must be made in home country prior to departing on trip from a GeoBlue eligible state

Why Choose GeoBlue?

Why Choose GeoBlue?

Go with a name and brand you can trust. GeoBlue is the trade name for the international health insurance programs of Worldwide Insurance Services, an independent licensee of the Blue Cross Blue Shield Association. GeoBlue health plans are offered in cooperation with certain local Blue Cross and Blue Shield companies, with a network that includes more than 90 percent of physicians and 80 percent of hospitals across the U.S. GeoBlue’s comprehensive portfolio of international health insurance plans demonstrates the commitment to covering members both at home and abroad.

Strength of a U.S. Insurer - Underwritten by 4 Ever Life Insurance Company, rated A- (Excellent) by A.M. Best. 4 Ever Life is an independent licensee of the Blue Cross Blue Shield Association.

GeoBlue Pays their Claims...

When you shop for a health insurance plan to cover yourself and your family what you are buying is really a promise to pay. A promise that if you find yourself in a situation where medical services are needed while you are traveling you want to know you have an advocate on your side to help guide you to the best possible medical care AND that your medical bills will be paid and done so in a timely manner. GeoBlue is that company. Click Here to view an actual case study that details how a Voyager Choice policy holder was treated.

When you shop for a health insurance plan to cover yourself and your family what you are buying is really a promise to pay. A promise that if you find yourself in a situation where medical services are needed while you are traveling you want to know you have an advocate on your side to help guide you to the best possible medical care AND that your medical bills will be paid and done so in a timely manner. GeoBlue is that company. Click Here to view an actual case study that details how a Voyager Choice policy holder was treated.

GeoBlue is Different

- Enjoy 24/7 Phone, Web and Mobile Support

- Prompt Access to Trusted Doctors and Hospitals

- Cashless Appointment Scheduling

- Paperless Claims Resolution

- Destination Health Intelligence

- Access to Worldwide Travel Alerts via GeoBlue website

Physician & Provider Network - What Good Is Health Insurance If You Can’t Find a Doctor You Trust?

GeoBlue has an elite network of doctors from most every specialty ready to see you in over 180 countries. Only a small fraction of doctors around the world meet GeoBlue’s exacting standards—participation is by invitation only. We seek out professionals certified by the American or Royal Board of Medical Specialties who speak English, and we factor in recommendations by over 158 Physician Advisors from all over the world.

GeoBlue assembles in-depth provider profiles so their members can choose with confidence, and they put formal contracts in place to ensure preferred patient access. GeoBlue doctors and hospitals bill GeoBlue directly so you don’t have to worry about filing a claim.

For members choosing a GeoBlue plan that offers benefits in the United States, you gain access to the largest national network and facilities that have been awarded the coveted Blue Distinction for superior medical outcomes. In the U.S., more than 80 percent of physicians and 90 percent of hospitals contract directly with Blue Cross and Blue Shield Plans.